The increasing numbers of British households rely on direct lending agencies to get instant cash help. As of today, private lending agencies have become the 1st choice of willing borrowers rather than regular banks and financial institutions. The wide range of unsecured short-term loans is available but the payday loan also called as salary loan, payroll loan, cash advance loan and payday advance, has emerged as the most sought after financial help in the UK during the last couple of decades. Is it the best option you must opt to meet out the emergency financial needs?

Almost anyone in a job with six months record of consistency is a good candidate for cash advance loan. The other prerequisites for being a cash advance loan borrower are – certified UK residency; 18 years’ age; regular employment; no charge of bankruptcy; salary bank account.

High cost of payday loan is no more a hidden fact now. These are popular credits because of the simplicity because the borrower doesn’t need to arrange a security or guarantor. The short-term period of 28 days also goes in your favor because you become free from repayment liability with 1st salary cheque. However, it has a darker side also; because you have to repay the entire amount in a single installment. So,

The payday advance loan industry of the UK, the world’s 2nd largest payday lending market after the US, is worth of £220 million. According to BBC, 760,000 salary advance loans were accounted in 2017 at an average value of £300 equaling to £228 million. The single most common payday advance borrowed is just the £100. Borrower always fears that the payday loan failure will lead to a loan shark. However, it is not the case now after the intervention of FCA.

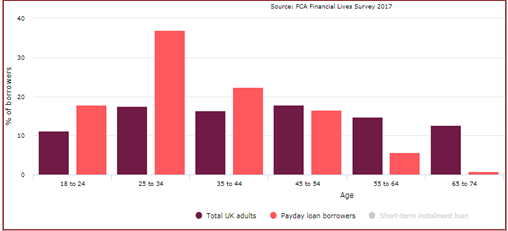

The majority of payday loan applicants come from 25 and 30 years age bracket; interestingly, the majority of these are single. Everything is found good regarding salary advance borrowing that is certified by the increasing demand of payday loan also but one statistic needs the attention of borrowers – ‘The people after getting a payday loan have an unexpected rise in expanding and outgoings’. Would you like to consider equally good other alternatives of payday advance loan?

| Authorized overdraft – Available for the short-term at comparatively low-interest rateBorrowing from credit union – Funds are provided even to bad credit borrowers but not as quick lie the salary day loan short-term installment loan- Better affordable option but comes with longer repayment liability Credit card advance- A no-cost financial help for a limited period provided by selected credit card issuers |

Before you apply to a most seen advertiser of payday loan nearest to you, explore your options – can you avoid and can you delay in fund getting? Have you explored the possibility of getting a Govt. benefit for the particular purpose? For example, insurance agency can help you manage the car broke down, urgent house repair or illness.

Proper documentation with the fair idea of your credit score is must have prerequisite before approaching to lender. Even if you find your credit score around 350-400, you can expect a good deal for salary advance loan. Short- list at least 5-6 payday loan lenders and compare them on the basis of offered deal, social repute, flexibility, diversity in services etc. Don’t forget to negotiate being at driver seat because you have other lenders also to try. Now, after getting the best priced salary advance loan, you will have to change the expending habits with a thought of extra income to pay the debt and to compensate the cost.

Concluding Note:

Guaranteed payday loans at direct lenders are easily available for almost any stable employee but this facility may dent your financial goals for long-term. Even if you pay the debt on time, you get an adverse mark in a credit report. A payday loan is a good option for short-term small amount need when you are left with no other option to get the required funds by the particular time.

Jennifer Powell embraced finance writing just the moment she started working as a finance executive with EasyCheapLoan, which is a direct lender in the industry. Jennifer has an exceptionally keen eye for details and used her skills to pen down numerous blogs and articles on finance. When asked, she simply replies with a look on her face that shows how genuinely she cares for people struggling with financial problems. Jennifer works dedicatedly as a finance professional and considers sharing both her experiences and knowledge to increase the financial literacy of people and businesses.