Money matters change with each new season of the year. Different months bring different costs and financial opportunities, too. Adjusting your budget regularly is very important to manage it all.

Winter means higher heating bills and holiday travel expenses. Getting ready for spring brings tax refund chances. Summer vacations and utility costs can strain budgets quite a bit. And fall means back-to-school costs plus upcoming winter prep.

Updating your budget for each season’s typical expenses is critical. It allows you to plan and save money better. Having a solid budget prevents surprises or stressful situations later on. It’s easier to cover costs when you expect them ahead of time.

Seasons also provide opportunities to cut costs in certain areas or to make temporary budget adjustments as needed. Flexibility is important when reviewing your budget throughout the year. Life changes constantly, so your budget needs to adapt accordingly.

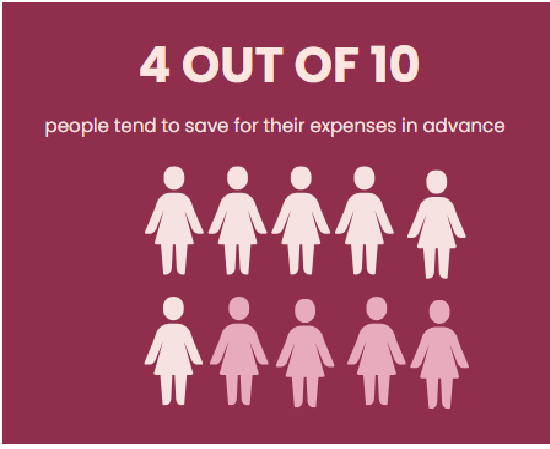

These show that about 40% of people are still saving for their expenses in advance rather than living in debt.

Unless you love your own company or you kind of love a life of solitude, you would love to socialise with your friends. It is quite obvious to feel peer pressure that pushes you over the edge, but there are many ways of socialising with your friends without burning a hole in your pocket.

Many a time, you find yourself overspending because you do not want to be ashamed of not being a generous sender to treat your friend. Unfortunately, it makes you run out of cash to meet your regular expenses, and, as a result, you end up relying on loans for bad credit with no guarantor and on benefits.

Here are some of the ways to socialise with your friends without compromising on your budget:

It can be hard to lay your soul bare to friends, but your true friends will surely understand your financial situation and be willing to help you achieve your goal. Of course, you do not have to give them an account of how much you have, but you can simply tell them you are turning over a frugal leaf.

When you tell them you are running out of money and would like to go Dutch, they will support your initiative. They will certainly understand that you want to do things for them despite being cash-strapped. They will appreciate it and support you.

A good way to save money is to find a savings buddy. You might have a friend who could be in the same boat. You can help each other achieve your goals. In fact, you do not need to spend a lot of time together in the bar or restaurant. You can simply invite over each other or have a leisure walk. Find people with the same hobbies in local communities and collaborate with them if you want to grow your network.

A night out is certainly expensive. When you are running out of money, you can reduce your gatherings with your friends. Make sure you plan your night outs so you know how much money you have to spend in a month.

You should keep it as little as possible so other important expenses like payments of a 5K bad credit loan are not halted. Once you have set aside money for a night out, you should ensure that you do not blow up your budget, which you can do by:

You do not need to hesitate to refuse your friend if you do not want to because of a tight budget. Socialising cannot compel you to make all events.

It is possible that you may not want to give up socialising with your friends. Maybe your friends do not want to change and you still like their company. There is nothing to worry about because you can use the following ways to save your money while having fun with them.

You should think of ways about how you can save money on your expenses.

You do not need to buy a different outfit for each night out. Whether you are having fun in the bar or you are gathering together on an occasion, you should try to mix and match your outfits. Use neutral colours. It becomes easier to set combinations.

The more unique the colour you choose, the more specific the combination it will make. Use eye-catching accessories if your outfit is simple and basic. If you still need a new party outfit, you should shop around. You can get something at a good bargain. Charity shops are also a nice place to buy party clothes at lower prices.

Travelling by your own car can be exorbitant as compared to the public transport. If you have a plan to pick up your friend on the way, you can split cab fares. Trains are cheaper than cars if you all have to travel longer distances.

You can get train tickets at lower prices by booking in advance. Some train operations provide extra discounts to people travelling in groups. Keep tracking if you can get additional discounts by using codes and coupons.

Socialising is important. It makes you feel connected to the world. However, it does not mean that you should not care about your money to keep up with your friends. You should carefully set a budget for socialising expenses and stick to it, no matter what.

You should learn to say no if you cannot meet your friends. It should feel so difficult. You cannot go over your budget. Otherwise, it will add to your financial troubles.

Fall means back-to-school costs and preparing for winter expenses. Holiday shopping also starts during this season. It’s important to budget carefully.

Kids need new clothes, supplies, tech and activity fees. These back-to-school costs can add up fast and make a list and budget accordingly.

According to VoucherCodes, parents in the UK spend £285 on back-to-school supplies per child.

The holidays will arrive before you know it. Start buying gifts little by little to spread costs out. Making purchases over time prevents a big cash crunch.

The fall weather transition also impacts energy bills. As it gets colder, heating costs rise. However, air conditioning may still be needed. Budget for higher utilities.

Fall is when major expenses start piling up quickly. Having a solid budget in place helps minimise stress. Get organised early for back-to-school, holidays and winter prep costs. It makes the chaotic fall season more manageable financially.

Adjusting your budget every few months is a wise strategy. Updating for each season ensures you stay financially stable. It prevents cash shortages or excessive, unplanned debts from sneaking up. By anticipating future costs, you can maximise your savings potential.

With proper planning, there’s less risk of overspending when expensive seasons arrive. Creating temporary budget changes is much easier, too, like cutting back in some areas to cover others temporarily. This seasonal budgeting approach allows you to maintain balance overall.

Anticipating and preparing for seasonal expenses gives great peace of mind. There’s no scrambling to cover surprise costs or suddenly tightening belts. Your finances simply flow smoothly throughout the entire year—all because you update your budget regularly for any shifts.

Jennifer Powell embraced finance writing just the moment she started working as a finance executive with EasyCheapLoan, which is a direct lender in the industry. Jennifer has an exceptionally keen eye for details and used her skills to pen down numerous blogs and articles on finance. When asked, she simply replies with a look on her face that shows how genuinely she cares for people struggling with financial problems. Jennifer works dedicatedly as a finance professional and considers sharing both her experiences and knowledge to increase the financial literacy of people and businesses.