Being an entrepreneur is not that easy than it just might look from the surface. There are tons of things that go into establishing a company. For the start-ups, the biggest challenge is taking care of business-related tasks and that too, with the limited resources. The majority of the young entrepreneurs fail in the early stage because of these difficulties that resist them to go on a full-fledged way.

The risks will always be no matter what kind of industry you are serving regardless of the size. However, you need to look for ways to keep expanding your business scalability. The higher will be the profits; the better will be for your brand to grow.

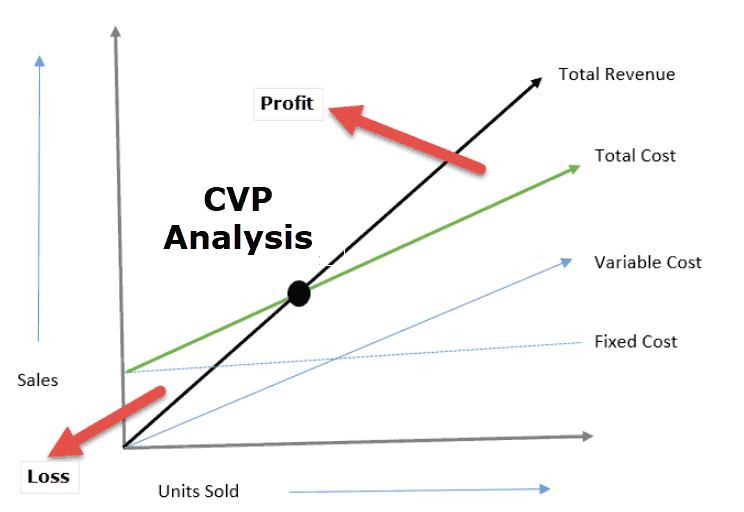

But, for the small or newly started business, this can be quite a hectic task. Thus, the first barrier should be to achieve the point of equilibrium where the revenue generated by the firm reaches to cost. It is where cost-volume-analysis can prove to be extremely beneficial. Let us understand this concept in a better way.

There is no denying the fact that risks are the constant part of a business. But there are ways to reduce the chances that keep circulating in the business. One such capable and a great idea is a cost-volume-profit analysis that helps the company figure the level or point from which the company can start making profits from its products.

CVP analysis is a financial estimation that will understand what should be the number of products that you need to sell to overcome the cost of production. Now, this can be extremely useful because it will help the firm take crucial steps to save the business from losses and generate high revenues.

The CVP analysis focuses on the most critical elements of the business that are:

The cost-volume-analysis is a tremendous managerial accounting method that can help in knowing how making a change in the cost and sales volume can affect the company’s profit. Also, you will know if there is a need to grow the production size. If this is the case and you need funds, go for inastant cash loans from any reputed borrower.

The CVP technique provides a plethora of benefits, of which the major ones are discussed below:

One of the most significant benefits of CVP analysis is that it will help in understanding what price factor can bring more profits in the business. Several factors go into choosing the price value of the product, and this indeed can help enormously.

Every brand wants to make a profit as this signifies that business is going towards the path of progress. Setting the price that can boost profitability is something that every business might be willing to adjust.

Another excellent benefit of CVP analysis is that it provides a complete insight into the activities being performed in the company. Now, this consists of everything, including from the cost required for the product making to the number of units needed and so on.

It can help the owners predict the effect that would occur by changing any of the variables of the product and how it would impact the business.

The Equation Method: This is a simple math formula that can help in doing the cost-volume-profit analysis. The formula is given as:The best thing about CVP analysis is that its calculation is quite simple and easy. Several ways are used for this which are given below:

Profit by the company = overall revenue – (Overall cost of the variables + Fixed cost)

(Unit Selling Price * quantity) – (Unit Variable Cost* Quantity) – Fixed Cost = Profit

Wrapping up, this was the complete briefing of Cost-Volume-Profit analysis and the numerous ways how it can benefit a particular company. This method will assist managerial professionals and owners to make better and informed decisions.

Jennifer Powell embraced finance writing just the moment she started working as a finance executive with EasyCheapLoan, which is a direct lender in the industry. Jennifer has an exceptionally keen eye for details and used her skills to pen down numerous blogs and articles on finance. When asked, she simply replies with a look on her face that shows how genuinely she cares for people struggling with financial problems. Jennifer works dedicatedly as a finance professional and considers sharing both her experiences and knowledge to increase the financial literacy of people and businesses.