New trade deals reshape how small firms source and sell goods across borders. When deals change, costs flow through supply chains with swift impact. British makers face higher fees on parts they’ve used for years without issue. These shifts often come with little warning, leaving scant time to plan ahead. Small shops feel these blows more than big firms with deep cash reserves.

Import rules sometimes block vital parts from reaching UK shops at any price. Certain key items become hard to find, no matter what firms will pay. A small technology firm might lose access to chips needed for its main product line. Such gaps can stop work and put deals with loyal clients at risk.

Trade shifts create short-term cash gaps that need quick fixes to bridge. Rising costs for parts drain money months before firms can ask more for their goods. This gap forces shops to pay more while still earning the same as before. The strain tests even firms that have always kept their books in good shape.

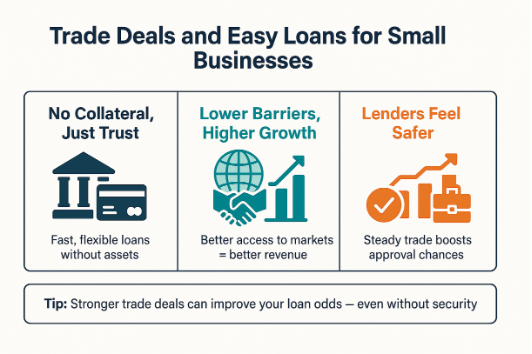

Loans made for firms with less-than-perfect credit offer timely help. These funds come through when the central banks move too slowly during market shifts. The money helps keep stock levels up despite higher costs to buy parts. Firms can still fill orders on time without cutting corners on quality.

These bad credit business loans work best as short bridges over specific trade troubles. They give firms room to breathe while making bigger changes to how they work. The funds help shops invest in new ways to handle changing market rules. With proper monetary support, strong firms come out better as they find fresh paths in shifting trade maps.

| Aspect | Details |

| Loan Amount | £1,000 – £50,000 (sometimes more with security) |

| APR Range | 29.9% – 99.9% (higher due to credit risk) |

| Repayment Term | 6 – 60 months |

| Collateral Required | Optional (secured loans may offer better rates) |

| Eligibility | UK-based business, poor credit score, proof of business income |

| Approval Speed | 1 – 5 working days |

| Loan Type | Unsecured, secured, merchant advance, invoice finance |

New trade rules often add fees to goods that cross borders for sale. Firms that once paid small fees now face much steeper costs on each load. These shifts hit small firms hard as they lack the cash just to ride it out. The price jump comes all at once, while they can only raise their own tags slowly. Many shops find they must choose what goods to keep and what to cut.

Costs climb for most items that form the core of many small shops. Parts for tools, key raw goods, and items meant for resale all cost more now. These rises flow from the first port stop to the final shop shelf. Small firms must pay upfront, which may take months to turn into sales. The cash gap grows each time new fees get tacked on at the border.

Small firms that sell abroad now face walls of rules and forms. Teams that once sent goods with just a few forms now fill stacks of papers. The time spent on this work takes hours away from making more to sell. Many shops find they need help just to keep goods moving to faraway lands. The cost of this help eats into the gains from each sale made.

New trade terms mean some goods now cost more to sell in key spots. Items that once had good price tags now must cost more to earn the same. Firms must check if they can still win sales when their goods cost more. Some find they must pull out of lands where they sold well for years. This shrinks their reach just when they need to grow most.

Trade pacts with some lands mean fees drop for firms that sell there. Goods that once cost too much to ship now make sense to send. Small shops find they can reach more people who want what they make. The best deals mean both sides drop fees that hold back trade. Firms that spot these gaps first tend to gain the newest sales.

Quick loans help firms grab new sales while hot spots stay fresh. Cash on hand means they can make more stock right when it sells best. They can hire more staff or buy tools to speed up their workflow. Fast funds help shops jump on deals that might slip past if they wait. Banks with forms that ask less and move quickly serve firms best here.

Unsecured loans with clear terms work well for firms with set trade paths. They let shops plan their growth based on real facts, not just hopes. With funds in place, a firm can take on big jobs it might pass up. The right loan helps bridge the time from when work starts to when cash comes in.

Smart firms seek UK sources for goods when foreign costs climb too high. They look for local makers who craft similar items to those they once bought abroad. These new ties often build lasting bonds that help beyond just the current trade issues. Local supply lines cut the risk of delays at ports and surprise rule changes.

Export firms now face more paperwork for sales to other countries. They must show proof of where each part of their products came from. This extra task adds hidden costs to keeping clients in other nations. Teams must spend hours on forms instead of making more goods to sell.

Jennifer Powell embraced finance writing just the moment she started working as a finance executive with EasyCheapLoan, which is a direct lender in the industry. Jennifer has an exceptionally keen eye for details and used her skills to pen down numerous blogs and articles on finance. When asked, she simply replies with a look on her face that shows how genuinely she cares for people struggling with financial problems. Jennifer works dedicatedly as a finance professional and considers sharing both her experiences and knowledge to increase the financial literacy of people and businesses.